Address

FPCCI Capital House, 5th Floor,

G-8/1, Mauve Area,

Islamabad - Pakistan (44000)

New Bong Escape Hydropower Menu

Hydropower Case Study

Hydropower- Case Study and theoretical Perspective

Comparison of 84 MW NBE with 87.9 MW Cannelton hydropower projects

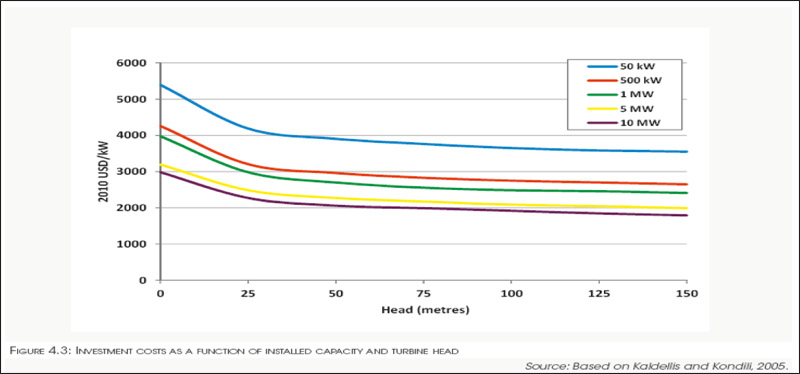

Hydropower projects are highly dependent on the hydraulic head; generally low head projects are more expensive than high head projects as they must process a large volume of water to produce the same power.

The relationship is shown in the following graph:

Source: International Renewable Energy Agency (IRENA) Renewable Energy Technologies: Cost Analysis Series

Hydropower projects are also greatly influenced by specific site conditions and individual features and characteristics. However, some benchmarking has been carried out as shown in the above graph.

An extract from the Hatch Canada low head hydropower report, validates the argument. Low Head Hydro Barriers Assessment: “Low head hydropower projects are generally thought to be uneconomical”. The Hatch Canada low-head hydropower report shows that projects at greenfield sites have a cost ranging from US$ 3.5 million to US$ 6 million per MW.

Low head projects are at the very high end of the cost spectrum for hydropower projects and the lowest head hydropower projects are at the very limit of viability for hydropower project development. Usually, in developed economies low head projects are the last sites to be developed and it is ironical that NBE HPP, a low head project is the 1st private hydropower project of Pakistan/AJ&K.

It is instructive to compare two low head hydropower projects – the New Bong Escape (NBE) hydropower project with the sister Cannelton HPP, in USA, which was completed at a cost of US$ 4.7 million per MW in 84 months compared with NBE which has been successfully commissioned at US$ 2.8 per MW in 39 months. It would be expected that the tariff for the Cannelton HPP, with a cost almost 70% higher than NBE HPP, would be substantially higher than NBE tariff of US¢ 8.55/kWh (levelized), based on the preliminary information available. Further information on the 87.9 MW Cannelton HPP on the Ohio River near Hawesville, Kentucky USA can be seen at:

https://www.power-technology.com/marketdata/cannelton-us/

The salient features of each project are tabulated in the following table:

|

Cannelton HPP, USA |

NBE HPP, Pakistan |

|

| Capacity |

87.9 MW |

84 MW |

| Start date |

May 2009 |

End 2009 |

| Commissioning |

June 2016 |

March 2013 |

| Construction time |

84 months |

39 months |

| Total Cost |

US$ 416 million |

US$ 233 million |

| Cost/MW |

US$ 4.7 million/MW |

US$ 2.8 million/MW |

| Gross head |

25 feet |

33 feet |

| Generating plant |

Horizontal type bulb-turbines |

Horizontal type bulb-turbines |

| No of units |

3 |

4 |

| Capacity/unit |

29.3 MW |

21 MW |

| Generation |

458 GWh/annum |

470 GWh/annum |

| Owners Engineer |

MWH USA |

MWH USA |

| Supplier |

Voith Hydro, Germany |

Andritz Hydro, Austria |

| Civil Works |

Intake approach channel, reinforced |

Intake approach channel, reinforced |

The cost of US$ 2.8 million/MW, for the NBE HPP, with a head of around 10 meters, water flow of about 1,000 m3 and power of 84 MW is at the lower end of the range while the cost for the 87.9 MW Cannelton HPP, at US$ 4.7/MW, is at the higher end of the range.

The NBE project scheduled completion time under the PPA was 42 months, itself a demanding target, but it was completed in 39 months achieving a world record as similar hydropower projects in USA on the Ohio River, which started in May 2009 about the same time as NBE with completion in June 2016, took 84 months to complete.

Though public hydropower projects in Pakistan have been subject to massive delays and cost overruns, the completion of NBE has shown that it is possible to complete complex projects, in the private sector, in record time and with negligible cost overruns compared to many of the hydropower projects in the public sector which have had cost overruns several fold the original cost.

This shows the high level of technical competence and development skills displayed by the NBE HPP project development team and management.